ICP Accountancy – affordable, experienced, thorough

Getting started with ICP Accountancy is as simple as picking up the phone and calling us. If you prefer, you can also contact us via e-mail.

Take home more of your pay.

We'll ensure you are as tax efficient as possible using your own LTD Company.

STEP 1

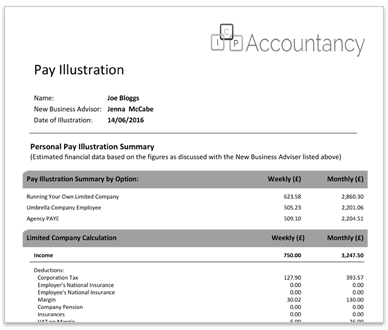

Request an Income Illustration & ebrochure about our service.

One of our experienced agents will take a few details from you so we can calculate your take home pay. This will then be sent to you in the form of a pdf so you can see the exact take home pay you will receive.

We take care of everything for you.

We take care of your company setup, all admin work, accounts IR35 reviews and PI Insurance.

STEP 2

We'll talk you through everything and answer any questions you have.

You'll be able to speak to one of our friendly team who will talk you through everything from the initial setup of your limited company right through to entering your expenses on your online portal.

We're specialist contractor accountants.

As Accountants you can rest assured you're in safe hands!

STEP 3

Complete a simple form and we'll get your LTD Company setup in 24 hours.

Within 24 hours (normally 3-4 hours) we will form your Limited Company for you and begin the process of setting up your business bank account, so you'll be up and running in no time!

What's Included?

- A dedicated team of qualified accountants as your first point of contact

- Formation of your limited company

- VAT and PAYE registration

- Free business bank account (Cater Allen)

- £2 million professional indemnity insurance (worth £350 + VAT)

- Unlimited IR35 reviews (worth £150 each)

- Acting as your registered office

- Full access to our cloud-based online portal so that you can create & email invoices, log expenses and pay yourself

- Quarterly VAT returns

- Your annual personal tax return (worth £175)

- HMRC tax investigations service

- Monthly payroll service & Real Time Information submissions (RTI)

- Annual Statutory Accounts

- Filing all statutory returns including Corporation Tax Returns

- Dealing with all correspondence from HMRC & Companies House

- Free Financial Services Review to maximise your earnings potential

- Advice on IR35 & S.660

- We will not pass on your details to other companies without your consent.